Value Added Tax, or VAT, is a tax that we are legally obligated to charge for residents of the European Union. If you’re not in the EU, VAT doesn’t apply to you. VAT is only charged to customers whose Registrant Contact Details list an address located in the EU.

Note: Due to Brexit and UK laws, customers with Registrant Contact Details located in the UK (United Kingdom) can no longer be exempt from VAT, even if they are a business.

For those of you who are in the EU, we do need to charge you a little extra at checkout because of VAT. The VAT amount is determined by country and ranges from 17% to 24%. However, VAT typically only applies to business-to-consumer sales, not business-to-business sales. If you are a business, you may be able to exempt yourself from VAT by adding a valid VAT ID Number to your Account Contacts. To do that, please refer to our article Adding a VAT ID to your account contacts.

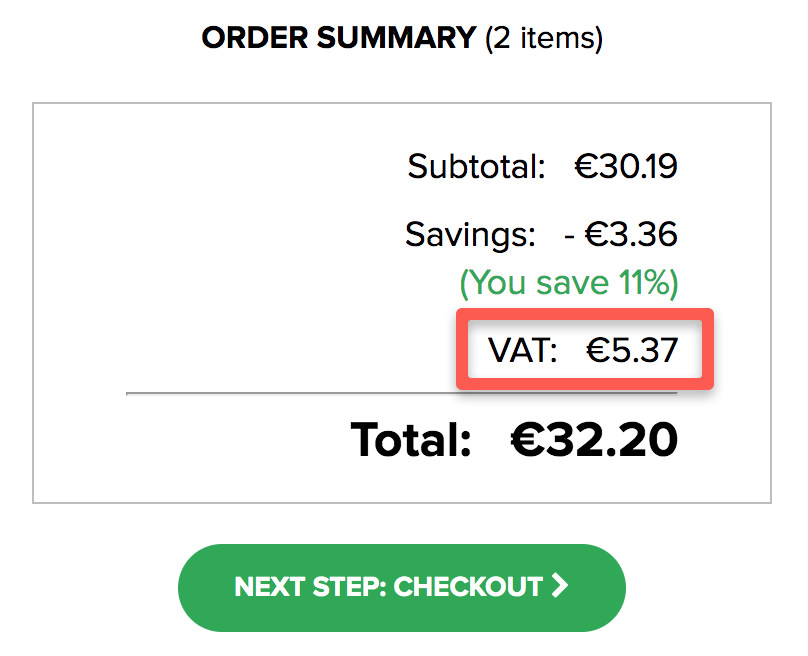

Here is what VAT will look like on your Review Cart Items checkout page before payment: