If your registrant contact details list an address in an EU country, we are required to charge Value Added Tax, or VAT. If you operate an eligible business, you can add a VAT ID Number to your Account Contacts to exempt yourself from this tax. To find out more about VAT, see our article here.

Note: Due to Brexit and UK laws, customers with Registrant Contact Details located in the UK (United Kingdom) can no longer be exempt from VAT, even if they are a business.

How to add your VAT ID number to your account

- Log in to your Name.com account.

-

Click on the User icon (

), located at the top right, open the drop down menu and click Settings and then select Default Account Contacts.

), located at the top right, open the drop down menu and click Settings and then select Default Account Contacts.

- If the country listed in the Registrant tab is a part of the EU, then the VAT ID field will be visible.

- Enter your VAT ID number in the VAT ID field on the Registrant tab and click Update.

Note: The system will show a VAT ID on all of the contact information tabs, but the VAT ID field in the Registrant tab is the only one that is read during checkout, so please make sure that the correct number is added specifically on the Registrant tab, if not on all of the tabs.

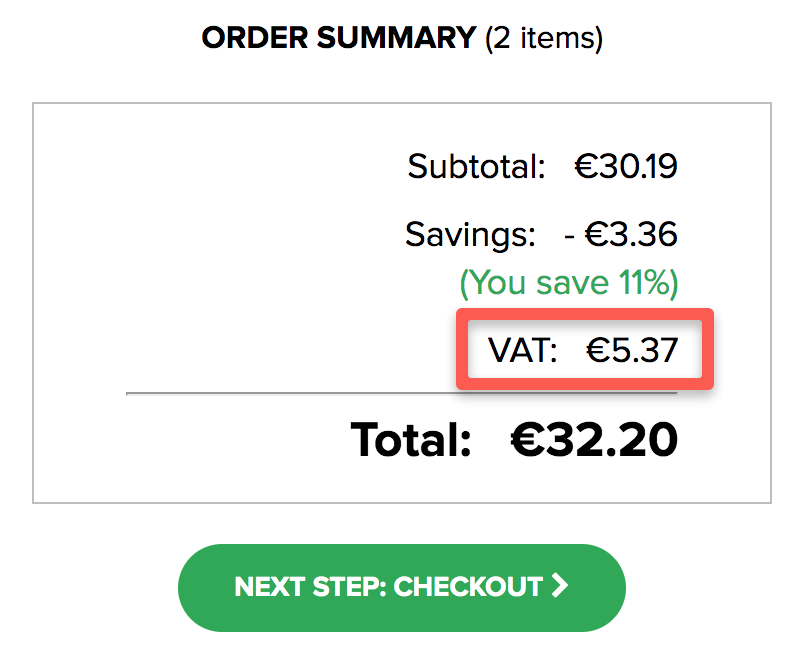

Here is what VAT will look like on your Review Cart Items checkout page before payment: